Play video

Play video

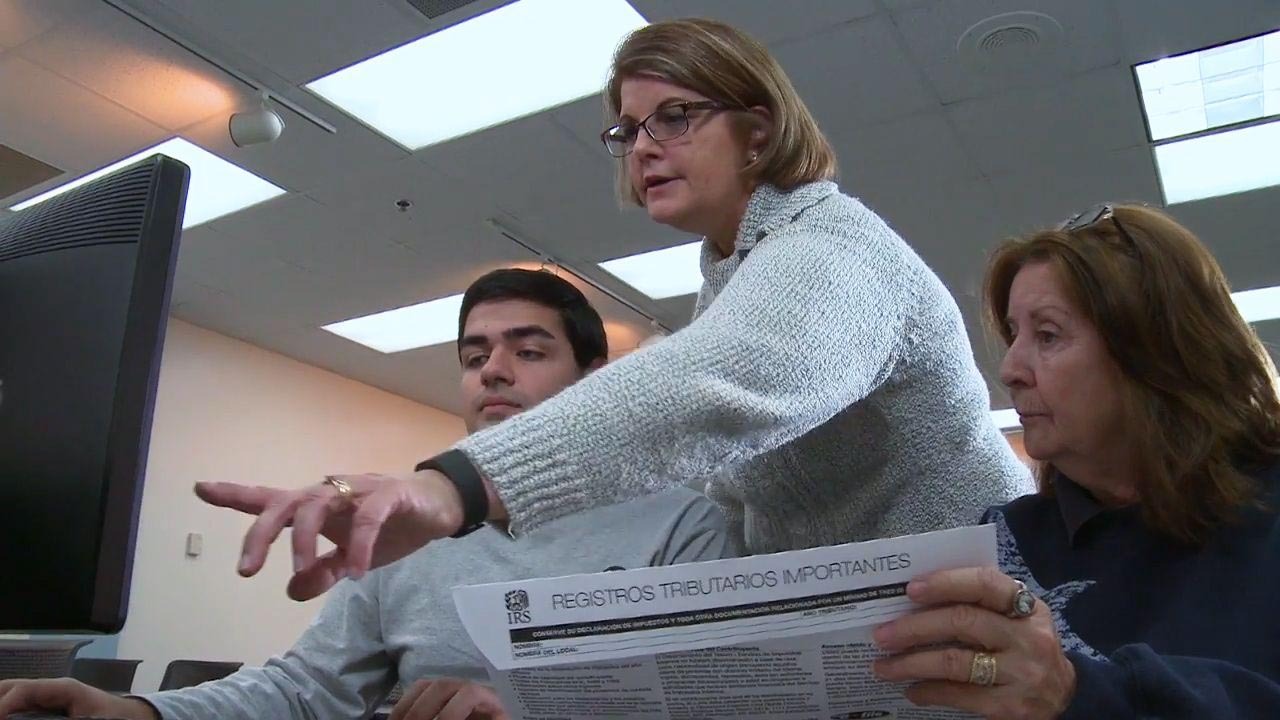

The rise of globalization and new regulatory processes has created a demand for accounting professionals across many sectors of business, government and nonprofit agencies. Accounting technology prepares you for employment as an accountant or accounting paraprofessional in occupations requiring analysis, evaluation, theory, and design. The coursework focuses on basic accounting functions as well as skills common to several fields of business, including finance, business law, and general business topics.

YEAR I – First Semester

†ACG 2021 Financial Accounting - 3 cr.

†CGS 2100 Computers Information Technology and Literacy - 3 cr.

†ENC 1101 English Composition I - 3 cr.

MAC 1105 College Algebra - 3 cr.

YEAR I – Second Semester

†ACG 2104 Intermediate Accounting I - 3 cr.

†ACG 2071 Managerial Accounting - 3 cr.

†ECO 2013 Principles of Macroeconomics - 3 cr.

†GEB 1011 Introduction to Business - 3 cr.

YEAR I – Third Semester

†ACG 2450 Microcomputers in Accounting - 3 cr.

†AMH 2020 Modern American History or †POS 2041, American Government - 3 cr.

YEAR II – First Semester

†ACG 2061 Computers in Accounting - 3 cr.

†GEB 2214 Business Communications and Technology - 3 cr.

Humanities General Education CORE - 3 cr.

†TAX 2000 Federal Tax Accounting I - 3 cr.

YEAR II – Second Semester

†ACG 2681 Financial Investigation - 3 cr.

†ENT 1411 Small Business Accounting and Finance - 3 cr.

†FIN 2001 Principles of Finance - 3 cr.

Natural Science General Education CORE - 3 cr.

YEAR II – Third Semester

†ACG 2949 Cooperative Education Internship in Accounting - 3 cr.

†ACG 2960 Comprehensive Examination – Financial Option - 3 cr.